This article is written in partnership with UK Government, a supporter of Peanut and women alike.

Did you know that there’s government support for childcare?

Before you go running off to the nearest nursery to drop off your kiddo, there are a few important things to know.

What childcare support is available?

Who’s eligible for it?

How do I apply?

Relax, mama.

We’ll cut through the confusion, answer all your burning questions, and help you claim.

There are a few different offers of government support to help with childcare, for all sorts of families, all on the Childcare Choices website, so let’s break it down.

In this article: 📝

- Funded childcare hours

- Tax-Free Childcare

- Universal Credit Childcare

Funded childcare hours

That’s right — the UK government can give you a helping hand with funded childcare hours — either up to 15 hours or up to 30 hours depending on how old your kiddos are and how much you earn.

But which one’s right for you and your family?

Let’s find out.

Universal 15 hours childcare

Let’s start with an easy one — 15 hours childcare, spread out over 38 weeks per year.

That’s up to 570 hours each year!

Plus, you can choose to use your hours on one or more childcare providers — and some can offer your 15 hours childcare over 52 weeks of the year. This means you can take less than 15 hours per week over more than 38 weeks- to cover holidays too.

Who is it for?

All families in England can get up to 15 hours of childcare for their 3 to 4-year-olds.

How to apply

- Look for approved childcare providers: Including childminders, nannies, playschemes, nurseries, clubs, registered schools, or home care workers at registered home care agencies. Our tip: try to find somewhere local, to keep travel costs lower, too.

- Check your eligibility: Using the handy Childcare Calculator to see exactly what you could be entitled to.

- Check your chosen provider is signed up for this government childcare support

- Take your child’s birth certificate to your provider

- You’ll be eligible the term after your child’s 3rd birthday

- Start using your universal 15 hours of childcare!

When to apply

As long as you’ve applied in time , the childcare support can start the term after your child is eligible and they’ve received a valid eligibility code — whichever is later.

When are the term dates? They start on 1st September, 1st January, and 1st April — so keep an eye on your calendar! These terms are ‘funding terms’ which may be different from your area’s school terms so make sure you double-check if they don’t align exactly.

It’s never too early to look into your childcare options — even if your child isn’t old enough for you to claim childcare support yet, it’s worth being aware of what’s available when they are old enough, so you can make the right choice for you and your family.

You can claim your childcare hours from the term after your child’s 3rd birthday, but you can apply from when they’re 2 years and 36 weeks old.

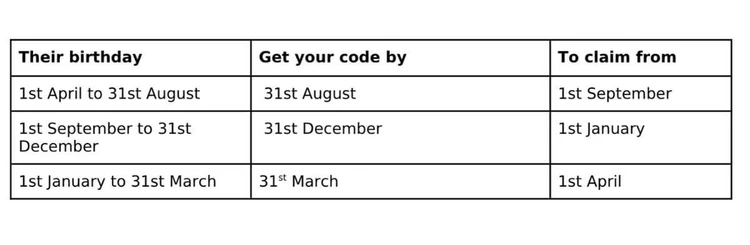

Let’s break down the different birthdays and dates, so you know when to get applying:

15 & 30 hours childcare for working parents

Working parents can also get additional hours of childcare per week to help them juggle work and life.

These offers can be used in the same way as the universal offer, which means you can use at a range of childcare providers including nurseries, childminders and playgroups, whatever works for your family.

It’s all about making it fit your life, not the other way around.

Who is it for?

30 hours childcare is currently available for eligible working families in England with children between 3-4 years old.

As long as each parent earns at least £167 per week, but no more than £100,000 adjusted net income per year (read all about adjusted net income and what that means), you can claim up to 30 hours of childcare per week over 38 weeks of the year.

Don’t forget childcare support is expanding! From April 2024, eligible working parents of two year olds can get 15 hours a week over 38 weeks of the year.

By September 2025, eligible working parents with children from 9 months up to school age could claim up to 30 hours of childcare a week. Read all about the upcoming changes to childcare support.

How to apply

For working families looking to claim 30 or 15 hours of childcare, here’s what you need to do:

-

Browse approved childcare providers: See if they’re approved on the Ofsted site or on the Department for Education’s list of childminder agencies.

-

Check your eligibility: Like with the universal hours, you can use the Childcare Calculator to see if you can get 30 hours — you may be able to claim other childcare support, too, like Tax-Free Childcare and Universal Credit Childcare.

-

Talk to your chosen provider: To see if they offer 30 or 15 hours childcare.

-

Apply online: You’ll need some info like your National Insurance number, Unique Taxpayer Reference (if you’re self-employed), the UK birth certificate of the child you’re applying for, and the date you started work. It takes about 20 minutes to complete, so grab a cuppa and apply here.

-

Give your code to your childcare provider: After applying, within 7 days (but sometimes straightaway), you’ll get your unique code to give to your childcare provider.

-

Start using your 30 or 15 hours of childcare!

-

Don’t forget- you need to reconfirm your eligibility every 3 months: To keep those 15/30 hours a week coming!

15 hours childcare for families receiving some additional forms of government support

Families in England receiving other government support (such as income support) with 2-year-olds can get up to 15 hours of childcare per year.

Visit the Childcare Choices website for more information if you think you could be eligible.

Tax-Free Childcare

Tax-Free Childcare means you can get up to £2,000 per child per year towards your childcare.

If you have a child with a disability you can receive up to £4,000 per child each year.

So how does it work?

Well, for every £8 you pay into your online childcare account, the government will top it up by £2.

You can use it alongside your 15 or 30 hours of childcare, too, on any regulated childcare, like childminders, nurseries, nannies, before and after-school clubs, and holiday clubs.

Who is it for?

Tax-Free Childcare has the same income eligibility criteria as 30 hours childcare — working parents must each be earning at least £167 per week, but no more than £100,000 adjusted net income per year (read all about adjusted net income and what that means), as long as you aren’t receiving Tax Credits, Universal Credit or childcare vouchers.

The great thing about Tax-Free Childcare is that it covers children aged up to 11 years of age, or up to 16 if your child has a disability.

How to apply

- Check if you’re eligible. Remember, you can’t use Tax-Free Childcare with Tax Credits, Universal Credit, or with Childcare Vouchers. Check here.

- Apply online and if you are eligible you’ll be given an online childcare account.

- Select your childcare provider(s) – don’t forget, they need to sign up to receive Tax-Free Childcare payments.

- Pay money into your childcare account, you can do this with a debit card but it’s usually quicker to set up a standing order or bank transfer. The government automatically adds the top up, and you can use the money when it shows as ‘available’

- Pay your childcare providers using the money in your childcare account. This can be for one off or regular payments to your provider.

- Reconfirm every 3 months. To continue getting the government top-up you need to confirm your details are up to date every 3 months, they’ll send you a reminder when you need to do this!

Universal Credit Childcare

With Universal Credit Childcare, you could claim back up to 85% of your registered childcare costs (up to £951 each month for 1 child, or £1,630 per month for 2 or more children) as long as you aren’t also claiming Tax-Free Childcare.

Use it for any registered childcare provider you like, whether it’s a nursery, childminder, or a mix of both — whatever’s best for your family’s schedule.

Who is it for?

Universal Credit Childcare is available for working families in England, Scotland, and Wales who are claiming Universal Credit with children under 17.

You could also be eligible to claim if you are due to start work.

How to claim Universal Credit Childcare

Visit Universal Credit childcare costs - GOV.UK (www.gov.uk) and/or speak to your work coach.

So, there you have it!

Navigating the world of childcare support might feel like another language at times, but you’ve got this, mama.

And if you’re after more advice and support, the Childcare Choices website has all you need to check your eligibility.

Remember, you’re not alone in this.

Millions of parents across the UK are accessing childcare support, so if they can do it, so can you!

If you want to chat to other mums who are going through the same thing or have wisdom to share, there’s a whole Community on Peanut, and we think you’ll fit right in. 🫶